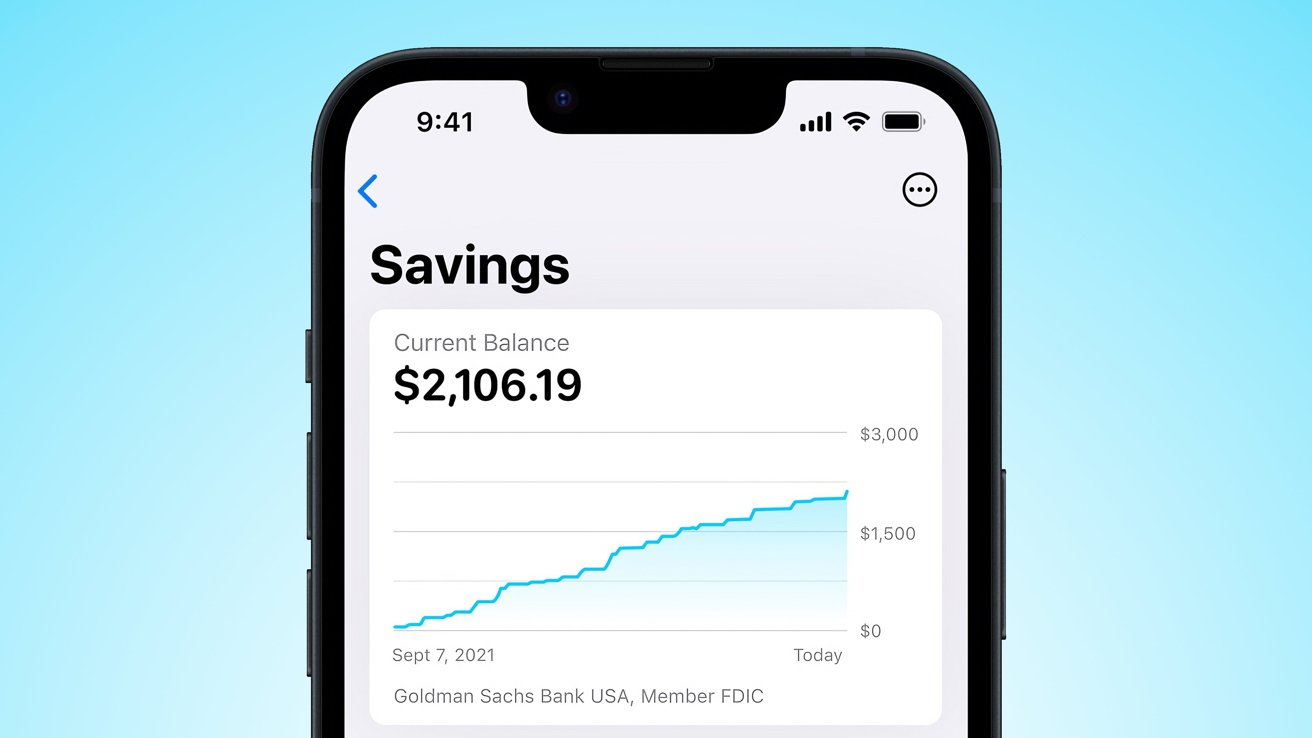

It’s understandable to feel a little uncertain when you hear that the interest rate on the Apple Card Savings Account has been reduced again. The latest cut, set to take effect on Friday, October 11, 2023, will bring the Annual Percentage Yield (APY) down to 4.1%. If you’ve been watching the ups and downs over the past year, this might not come as a complete surprise, but it’s still worth pausing to take stock of the situation — especially if you’re balancing expectations around your savings goals.

When the Apple Card Savings Account first launched in April 2023, it came with a very attractive 4.15% APY. For Apple users, this high-yield savings account felt like a natural choice, seamlessly integrating with the Apple ecosystem and especially appealing for those already enjoying the perks of the Apple Card’s Daily Cash. By January 2024, the interest rate even climbed to 4.5%, a cause for celebration among savers who were enjoying returns in a generally favorable market for interest rates. But since then, the rates have noticeably edged down, first to 4.4% in April, then to 4.25% in September, before this current reduction to 4.1%. You’re likely asking, “What’s going on?”

If you’ve been feeling a little uncertain about these changes, you’re not alone. Many savers who signed up for the account during its early days may be feeling frustrated or confused by the declining rates. It’s important to keep in mind, though, that these shifts aren’t entirely within Apple’s control—larger economic forces are at play.

So, what should you take away from this? The fact that the 4.1% APY still offers a relatively strong return compared to many traditional savings accounts tells us that it’s not all bad news. Despite the drop, the Apple Card Savings Account remains a compelling option, especially for those who value the convenience of managing everything through the Apple Wallet app. And even though rates are falling here and across the market, the changes are happening in a broader context that affects savings options everywhere.

More changes may be in store, but there are still opportunities to make your savings work for you. Stay tuned for details on what’s behind this rate drop, how Apple’s offer compares to other savings accounts, and what this means for your future savings strategies.

The recent drop in interest rates on Apple’s high-yield savings accounts may raise concerns, but the context is vital in understanding the “why” behind this change. At first glance, you might be wondering why Apple would cut rates on such an enticing product, especially since high-yield savings accounts have been on the rise in recent years. The answer has less to do with Apple itself and more with broader economic conditions, particularly movements in the Federal Reserve’s interest rate policies.

Let’s break it down: In September 2023, the Federal Reserve lowered its key interest rates, effectively signaling the entire market, including the financial products housed under Apple’s brand, to adjust. Interest rates in high-yield accounts often correlate closely with the federal funds rate. When the Fed lowers rates, it makes lending cheaper but has the side effect of reducing the returns savers receive on interest-bearing accounts. So the shift in Apple’s APY from 4.25% to 4.1% was largely inevitable following the Fed’s recent actions. Apple, like many other financial institutions, must adapt to these external forces.

Your immediate reaction might be frustration: after all, no one wants to see their potential savings grow more slowly, especially if they joined when the rate was at a promising 4.5% earlier this year. However, given these economic forces, the rate cut is less of a reflection on Apple’s specific product and more of an outcome of the entire financial system undergoing adjustments. Apple’s savings product is essentially feeling those same market tremors as every other high-yield savings account on the market. It’s not a decision made in isolation.

When interest rates first soared in 2022 and early 2023, the Federal Reserve was trying to combat inflation, leading many financial institutions to offer uncharacteristically high rates on savings products. However, as inflation shows signs of settling, and the economy steadies itself, those rates are expected to come down across the board. It’s not just Apple users who noticed a dip—other banks and financial institutions are seeing similar reductions in their high-yield accounts.

So, while the cut to 4.1% might feel like a setback, it’s part of an overall trend occurring in the financial sector. It’s also worth noting that, even after this reduction, Apple’s offering remains competitive in the high-yield savings account landscape.

More cuts could occur as the economic environment continues to evolve, but it’s helpful to recognize that these changes come from a desire to stabilize the broader economy rather than to diminish your personal savings strategy. As markets shift, your best move will be to stay adaptable, aware of your options, and trust that—even in these times of change—you can still build a solid foundation for your financial future.

When comparing Apple Card Savings with other high-yield savings options, it’s easy to feel some disappointment, especially with the recent drop to 4.1% APY. On the surface, Apple’s rate might seem to lag behind some of the other big players in the financial landscape. But let’s look a little deeper at what’s happening and how this impacts your broader savings strategy.

Currently, many alternative savings accounts still offer rates between 4% and 5%. For example:

- Ally Bank: As of October 2023, Ally Bank offers an APY of around 4.25%, which has consistently kept it in the competitive range for savers looking for stable returns.

- Marcus by Goldman Sachs: Known for its straightforward platform, their savings accounts provide an APY of approximately 4.30%, making it one of the more attractive options tied to a well-established financial brand.

- Capital One: Their 360 Performance Savings Account offers a current APY of 4.20%, another solid choice for achieving decent returns without much hassle.

While these rates may slightly edge out Apple’s offer, it’s not always about chasing the highest number—especially if you’re navigating multiple accounts and institutions. Choosing where to keep your savings often comes down to a blend of factors such as convenience, security, and the overall experience.

Apple Card Savings, despite offering a slightly lower APY, still has some definitive advantages. Remember, it integrates seamlessly with the Apple ecosystem, which may be significant for those who value having everything—from Daily Cash to tracking their financial goals—in one place. You’re already living in a day-to-day flow that revolves heavily around Apple’s products and services, and having a savings account right in your Apple Wallet fits seamlessly into that routine.

Moreover, the absence of fees coupled with the ability to easily funnel cash back rewards directly into your savings at no extra cost keeps Apple Card Savings quite competitive in its own way. You might not gain a massive percentage bump in APY, but the convenience of those automatic daily deposits from your Apple Card purchases could mean your savings accumulate faster than expected—even with a slightly lower rate.

That said, the 4.1% rate is not far off from the industry leaders. In the long run, if you’re an Apple ecosystem loyalist, the seamless experience and convenience may hold enough value to outweigh the marginally higher interest offered by competitors. However, if your main focus is on squeezing every bit of interest out of your savings, it might make sense to look around and see if one of the alternatives serves your goals better—at least in the short term while rates are fluctuating.

The truth is, there isn’t a single “right” answer. It depends on what matters most for you—whether that’s the ease and integration Apple offers, or perhaps maximizing every penny of interest through a different high-yield account. Whatever path you choose, it’s essential to keep an eye on shifts in the financial landscape and stay flexible, as market conditions may continue to evolve throughout the next year.

While it’s easy to feel put off by the recent change in the Apple Card Savings’ APY, it’s crucial to keep in mind that this account offers more than just interest rates. Let’s dive deeper into the various features and benefits that, despite the lower return, continue to make this savings account a noteworthy option for many Apple enthusiasts.

- Seamless Integration with Apple Ecosystem: One of the standout features of Apple Card Savings is how perfectly it integrates with the broader Apple ecosystem. If you’re already an Apple user, especially an Apple Card holder, managing your savings becomes effortlessly convenient. You can navigate everything through the Apple Wallet app, allowing you to track your savings, daily cash deposits, and spending in one location. It’s certainly ideal for anyone who appreciates simplicity and efficiency. No login to another app, no fuss—just a smooth flow as part of your daily Apple routine.

- Automatic Daily Cash Deposits: Now, this is a major perk that’s unique with Apple’s offering. Your daily cash back rewards from Apple Card purchases, typically between 1% to 3%, can automatically funnel into your Apple Card Savings account. While other savings accounts might offer higher interest, Apple’s focus on automating the saving process ensures that you’re consistently growing your balance—it’s essentially an effortless way to put money aside. You won’t even need to think about making transfers. Over time, this small-but-consistent stream could quickly build into something substantial without you lifting a finger.

- No Hidden Fees or Minimum Requirements: Many traditional banks burden their customers with monthly maintenance fees, minimum balance requirements, or transaction-related charges. Not here! With the Apple Card Savings Account, there are no fees to worry about, and no minimum balance is required to maintain the account. This feature is especially reassuring for newcomers to savings, students, or professionals who want to avoid nickel-and-dime fees that slowly chip away at their hard-earned deposits.

- Total Flexibility for Withdrawals: Unlike some accounts that have restrictions or penalties when you want to access your savings, Apple offers an open-door policy. You can withdraw your funds at any time with no strings attached. All you need to do is initiate the transaction through the Wallet app—whether you’re sending the funds back to your Apple Cash balance or to a linked external bank account. This flexibility ensures that your savings remain liquid and accessible no matter what financial goals (or emergencies) pop up along the way.

- FDIC Insured—Peace of Mind: Everyone desires safety and security when it comes to their savings, and Apple provides that peace of mind by ensuring the Apple Card Savings Account is FDIC-insured up to 0,000. This means that even in the unlikely event of a bank failure, your funds are protected by federal insurance. So, despite any concerns you may have about fluctuating interest rates, you’ll know that your money is safe from risk when it’s parked in your Apple Savings.

Ultimately, while no one loves seeing interest rates dip, Apple Card Savings still holds strong in terms of flexibility, ease-of-use, and integration. The features we’ve discussed continue to make it appealing, particularly for those who already use and appreciate Apple’s ecosystem of products and services. Whether you prefer the seamless flow of earnings from Daily Cash or the pure convenience of managing everything in one app, this account offers more than just interest—it offers a hassle-free way to save and grow your money.

Next, we’ll take a deeper look at the future trajectory of these savings rates and discuss what you might want to watch out for moving forward in this ever-changing economic environment.

The recent and consistent drop in the interest rate of the Apple Card Savings Account raises questions about what’s to come for future savings rates. It’s only natural to wonder whether these reductions will continue and how that might impact your overall savings strategy—especially if you’re using the Apple Card Savings Account as a key part of your financial plan.

To begin with, it’s important to acknowledge that interest rates on high-yield savings accounts are directly influenced by broader economic shifts. Banks and financial institutions, including Apple’s partner institution for the savings account, **Goldman Sachs**, adjust their rates in response to policies set by the Federal Reserve. As we saw with the most recent reduction, the Federal Reserve’s decision to lower benchmark interest rates in **September 2023** played a significant role in the subsequent dip in returns offered by the Apple Card Savings Account.

Looking ahead, it’s likely that the Federal Reserve’s future decisions may continue to shape the landscape of savings account rates. While it’s always difficult to predict precisely when and how rates will change, the general consensus among economists suggests that rates may remain relatively low in the near term as the broader economy stabilizes. However, if inflation were to rise again or if other macroeconomic challenges emerge, the Fed might adjust its course, which could drive savings rates upward once more.

For those concerned about the possibility of rates falling even further, it’s worth considering some strategic approaches to navigate the uncertainty. One option is to remain patient and recognize that a 4.1% APY is still significantly higher than what many traditional or big-name banks offer, with some falling well below 1% in their savings products. Even if the Apple Card Savings Account experiences another reduction, your returns will still likely surpass rates from banks that haven’t been competitive with their interest offerings for years.

If, however, you prioritize maximizing your interest earnings and feel confident in switching between savings options, there are alternative financial products to explore. Right now, some high-yield accounts from banks like **Marcus by Goldman Sachs** or **Ally Bank** are maintaining rates slightly higher than Apple Savings, but it’s critical to remember that those rates are vulnerable to the same economic forces. What looks like a better deal today might change tomorrow if economic factors dictate another industry-wide rate adjustment.

Beyond the external factors shaping savings rates, it’s also important to examine your own financial goals. If you’re saving for a long-term objective, such as an emergency fund or a major life milestone, and you’re primarily looking for stability, the Apple Card Savings Account’s other benefits—such as automatic Daily Cash contributions and no-fee structure—might outweigh the incremental difference in APY you could seek elsewhere. For short-term goals or for more hands-on savers aiming to optimize each percentage point, diversifying between multiple savings accounts or even considering certificates of deposit (CDs) might be worth exploring if available rates are higher than Apple’s for longer-term locked deposits.

In the end, the key takeaway is that rates will likely continue to fluctuate, and while the exact trajectory for the Apple Card Savings Account is unknown, maintaining flexibility in your approach is crucial. It’s understandable to be apprehensive about rate changes—especially when you’re relying on those returns to give your savings an extra boost—but staying informed and considering a balanced strategy can empower you to make the best financial decisions moving forward.

Rather than feeling discouraged by temporary adjustments, a savvy approach might be to think bigger picture. The Apple Card Savings Account can still provide value as part of a broader, holistic savings plan that prioritizes both convenience and returns. And as long as you keep an eye on the market and adapt as needed, you can continue to set yourself up for long-term financial success—even through periods of change.