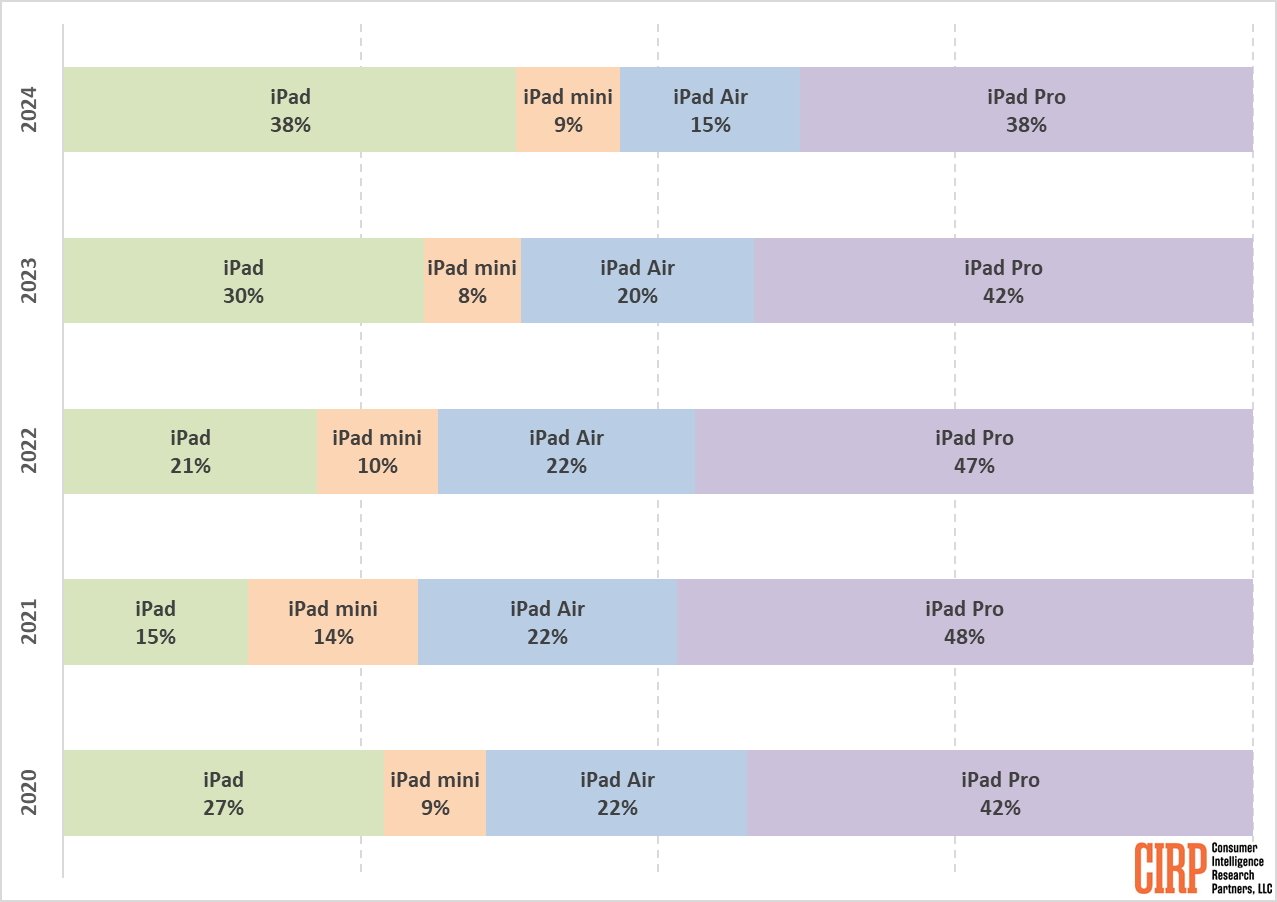

iPad Models Share (twelve months ended December of each year). Image credit: CIRP

Apple’s pricing strategy is anything but random. The company has expertly crafted a system that intuitively guides consumers toward different buying decisions without making the process feel overwhelming. The familiar “Good, Better, Best” structure plays a major role in this approach, and it continues to be remarkably effective.

At its core, this pricing framework is designed to appeal to a wide audience, catering to those who are budget-conscious, those who seek an improved experience with enhanced features, and those who demand nothing but the absolute best. It removes decision fatigue by offering clear, distinct choices rather than overwhelming consumers with too many variations. More importantly, it subtly encourages buyers to gravitate toward Apple’s favored models.

For many customers, the appeal of the entry-level iPad is obvious. It’s affordable, reliable, and seamlessly integrates into Apple’s broader ecosystem. Parents purchasing for their children, students looking for a lightweight study tool, or casual users who just need an everyday device for streaming and browsing naturally see it as an excellent value. And in an era where economic concerns are top-of-mind, this budget-friendly option has proven to be a popular choice.

On the other end of the spectrum, the premium iPad Pro is equally enticing, but for a different audience. Professionals, creatives, and tech enthusiasts are willing to pay for the top-tier experience. Apple ensures that the flagship iPad models include cutting-edge technology, from powerful M-series chips to advanced display technology and superior accessory support. For this group, the price is secondary to the performance and flexibility these models offer.

Interestingly, the middle-tier option—the iPad Air—often finds itself struggling in this landscape. Unlike traditional pricing models where consumers generally settle for the “Better” choice as a balanced compromise, Apple customers tend to either stick with the most affordable option or splurge for the best one. This trend is seen across Apple’s product lines, not just with iPads but also with iPhones and Macs.

By maintaining a clear tiered pricing strategy, Apple ensures that every type of customer finds an option that feels purpose-built for their needs. Whether looking for an everyday tablet or a professional-grade device, consumers know exactly where they fit within Apple’s ecosystem—making the purchase decision feel natural and, perhaps more importantly for Apple, justified at their chosen price point. As a result, this pricing approach continues to drive strong sales and reinforces Apple’s reputation as a premium brand that offers both accessibility and top-tier innovation.

Consumer preferences are constantly evolving, influenced by economic conditions, technological advancements, and shifting needs. Over the past few years, Apple’s iPad sales have reflected a notable trend: consumers are increasingly favoring either the most affordable or the most premium options, leaving the middle-tier iPad Air struggling to find its place.

The surge in entry-level iPad sales can largely be attributed to economic factors. With inflation concerns and rising costs across various industries, many consumers are more mindful of spending. The baseline iPad—often the most budget-friendly option—is perceived as offering excellent value. It delivers a solid Apple experience, with access to the same core apps, services, and ecosystem benefits as its pricier counterparts. For families, students, and budget-conscious buyers, this makes it a compelling choice.

Additionally, the rise of remote work and virtual learning has further emphasized the appeal of an affordable yet capable device. Households looking for multiple devices for children’s schoolwork, video calls, or casual entertainment naturally gravitate toward the least expensive option that still ensures reliability. The introduction of features like a more modern design and improved display resolution in the latest entry-level models only strengthens this preference.

While cost-saving measures drive budget-conscious buyers toward the base iPad, professionals and power users remain drawn to the iPad Pro. This high-end model has become a staple for creatives, business users, and tech enthusiasts who rely on top-tier performance. Whether for video editing, digital illustration, advanced multitasking, or immersive gaming, the iPad Pro continues to stand as an unrivaled tool that justifies its premium price.

Apple ensures that the highest-priced iPads integrate the most cutting-edge technology, reinforcing their appeal to those who want the best in power and future-proofing. Features like ultra-responsive ProMotion displays, desktop-class M-series chips, and enhanced Apple Pencil support position the iPad Pro as more than just a tablet—it’s a serious workstation for professionals on the go.

The challenge, however, lies with the mid-tier iPad Air. Historically, consumers have viewed mid-range devices as the logical compromise between affordability and performance. But Apple’s audience doesn’t always align with that expectation. Compared to the more affordable base iPad, the iPad Air often seems like an incremental upgrade, lacking the standout features that justify its higher price. And when premium buyers look at the Air versus the Pro, many choose to take the leap to the latter, believing the additional investment is worth it.

Ultimately, consumer behavior suggests that buyers tend to settle at either side of the pricing spectrum rather than in the middle. Whether driven by cost-efficiency or a desire for top-tier performance, the majority of Apple’s customers have a clear sense of what they want from an iPad. This trend is likely to continue unless Apple shifts its strategy, making the mid-tier offering more distinct in terms of features, capabilities, or pricing.

The iPad Air’s struggle to capture significant market share highlights an important challenge for Apple: how to differentiate the middle-tier option in a way that makes it indispensable. As it stands, the Air sits in an awkward position between two compelling choices—an affordably capable entry-level model and a powerhouse Pro lineup with best-in-class features.

One of the key reasons the iPad Air isn’t thriving is the gradual narrowing of feature gaps between it and the base model. In previous generations, the Air was the natural upgrade for those who wanted better performance and a slightly more modern design without committing to the price of an iPad Pro. However, recent refreshes to the entry-level iPad have put it much closer to the Air in terms of form factor, making the latter seem like a marginally improved version rather than a must-have middle ground.

For example, the introduction of USB-C to the base iPad removes one of the Air’s former selling points. Similarly, improvements in display quality and design in the lower-tier model mean that some buyers no longer see a compelling reason to spend extra for what feels like modest enhancements. The performance differences, while notable on paper, don’t always translate into substantial real-world benefits unless the user engages in more intensive tasks.

On the other side, the gap between the iPad Air and the iPad Pro is more distinct, but not necessarily in a way that benefits the Air. Buyers looking for advanced capabilities, whether it’s ProMotion displays, higher refresh rates, superior cameras, or more powerful chips, find that the Pro’s advantages make the extra cost justifiable. Apple’s strategic placement of premium features—such as better Apple Pencil functionality and more RAM—in the Pro lineup also reinforces its dominance over the Air.

Compounding this challenge is the fact that Apple buyers tend to fall into two main categories: those who seek affordability and those who demand the best. Consumers in the Apple ecosystem often prioritize long-term value over initial costs, making them more likely to either go for the top-tier model or stick with the most budget-friendly option. The iPad Air, unfortunately, lacks a unique selling proposition that can sway these buyers decisively in its direction.

The declining share of the iPad Air in recent sales reports suggests that Apple may need to rethink its approach to the mid-tier segment. Could a significant processor bump, exclusive software features, or redesigned accessories make it more appealing? Or perhaps a small price adjustment could carve out a clearer distinction between the base model and the Air? With shifting consumer preferences, Apple must find a way to make the Air feel less like an in-between choice and more like a compelling standalone product.

For now, the iPad Air remains an excellent device, but until Apple positions it more distinctly within its lineup, it may continue to struggle as buyers either save money with the entry-level iPad or go all-in with the Pro. The question isn’t whether the “better” tier can work—it’s whether Apple can redefine what makes it worth choosing.

Apple’s ability to navigate shifting consumer preferences has been instrumental in maintaining its grip on the tablet market. However, the sales distribution highlighted in recent reports suggests that the company may need to make strategic adjustments to sustain growth. With the entry-level iPad reclaiming significant market share and the iPad Pro continuing its dominance, Apple is faced with the challenge of ensuring that its overall iPad lineup remains compelling—not just for power users and budget-conscious consumers, but for those in between as well.

The growing preference for the cheapest and the most premium iPad models has implications beyond just sales figures. It speaks to how Apple’s broader strategy of product differentiation and tiered pricing influences purchasing behaviors. If the base model continues to gain traction, Apple may focus on strengthening its foothold in the entry-level market, offering modest yet meaningful updates that keep the device appealing without dramatically cutting into iPad Pro sales. This could mean iterative improvements, such as better display technology, processor enhancements, or refined accessories, all while keeping the price competitive.

On the premium side, Apple is unlikely to slow down its efforts to make the iPad Pro the pinnacle of tablet computing. The integration of M-series chips, advanced display features, and increasingly desktop-like capabilities suggests that Apple sees this device as the future of portable productivity. As consumer demand for professional-grade devices grows, particularly in creative industries and mobile productivity sectors, the Pro will likely continue to receive the most cutting-edge advancements in Apple’s tablet lineup.

But the real dilemma lies with the iPad Air. Apple must determine whether this middle-tier device serves a meaningful role in its product strategy, or if it needs a major repositioning to stay relevant. A potential course correction could include making the Air more differentiated by introducing exclusive software capabilities, hardware enhancements, or possibly adjusting its pricing to create better separation from the base iPad.

Beyond individual product decisions, Apple’s overall strategy will be shaped by broader market forces. The rise of foldable devices, evolving consumer expectations around hybrid work and digital creativity, and sustained competition from brands like Samsung and Microsoft will all influence how Apple refines its iPad offerings. If consumer demand continues to bypass the mid-tier, the company may need to reconsider its three-tiered approach entirely, instead focusing on a lineup that more clearly aligns with contemporary usage patterns.

Whatever direction Apple takes, one thing is clear: the company’s deep understanding of how people interact with technology gives it a unique advantage. Apple isn’t just selling tablets; it’s selling an ecosystem, a seamless experience that keeps consumers engaged across devices. Whether that means preserving the “Good, Better, Best” structure or redefining it altogether, Apple’s mastery of product positioning ensures that, no matter what changes come, the iPad will remain a cornerstone of its hardware strategy.